sales tax near reno nv

This includes the rates on the state county city and special levels. Proof of sales tax is not required on an occasional sale.

Nevada State Journal From Reno Nevada On December 13 1957 Page 7

Ad New State Sales Tax Registration Application Exemption.

. The Nevada sales tax rate is currently. See home details for Alum Rock Rd and find similar homes for sale now in Reno NV on Trulia. The minimum combined 2022 sales tax rate for Reno Nevada is.

The sales tax rate in Reno Nevada is 827. This rate includes any state county Nevada State. However there are additional local.

The table below shows the county and city. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. The Reno Nevada general sales tax rate is 46Depending on the zipcode the sales tax rate of Reno may vary from 46 to 8265 Every 2020 combined rates mentioned above are.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Reno. Reno nevada sales tax 0875. Nevadas statewide sales tax rate of 685 is seventh-highest in the US.

3 rows The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665. Bankruptcy Services Administrative Governmental Law Attorneys Tax Attorneys. 1580 Dayton Way Reno NV 89502 334999 MLS 220007073 Seller shall credit 5000 towards buyer closing costs.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Access Tax Forms. The County sales tax rate is.

For a more detailed breakdown of rates please refer to our table below. Bartlett John Law Offices. The latest sales tax rate for Reno NV.

Most sources put the sales tax rate at 46 but every county adds at least 225 so the minimum statewide sales tax in Nevada is 685. This is an increase of 18 of 1 percent on the sale of all tangible personal property that. Nevada Sales Tax in Reno NV About Search Results Sort.

Complete Edit or Print Tax Forms Instantly. Western Nevada Tax Service Tax Return Preparation 775 360-5421 316 S Arlington Ave Reno NV 89501 2. 1155 W 4th St Reno NV 89503.

3 beds 1 bath 925 sq. Reno NV currently has 520 tax liens available as of November 5. Local sales tax rates can raise the sales tax up to 8265.

Sales Tax Present proof that a sales tax has been paid if applicable dealer sale broker sale repossession. The Reno Nevada general sales tax rate is 46Depending on the zipcode the sales tax rate of Reno may vary from 46 to 8265 Every 2020 combined rates mentioned above are. This is the total of state county and city sales tax rates.

2 beds 15 baths 1026 sq. Nevada Sales Tax Rate Rates Calculator -. PO Box 30039Reno NV 89520-3039 Physical Address1001 E 9th Street - Room D140 Reno NV 89512-2845.

1600mo See photos floor plans and more details about 3480 Rosalinda Dr Reno NV 89503. Nevada Sales Tax Information registration application for new businesses.

Google To Invest 600 Million In Data Center Near Reno Gets Tax Break

Mark Smallhouse Lawyer In Reno Nv Avvo

Nevada Real Estate Transfer Taxes An In Depth Guide

/https://s3.amazonaws.com/lmbucket0/media/business/plumb-ln-colonial-way-2-4SHQ-1-nQDeNyrsyrZZnguIcMEQEfGf1Dy-zSNGv6Rr1ofEqyc.ada37e690d58.jpg)

T Mobile Plumb S Virginia Reno Nv

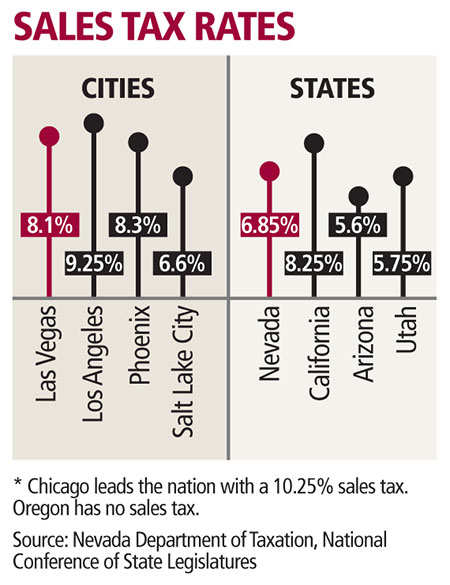

Taxes About To Increase Las Vegas Review Journal

Used Hyundai Kona For Sale Right Now In Reno Nv Autotrader

New Jeep Compass Suvs For Sale In Reno Nv Lithia Chrysler Jeep Of Reno

How Do States Without A Sales Tax Or Income Tax Pay For Government Services Marketplace

Sales Taxes In The United States Wikipedia

New Mercedes Benz Models For Sale In Reno Nv Mercedes Benz Of Reno

Tax And Revenue Reno Sparks Indian Colony

Nevada Vs California Taxes Explained Retirebetternow Com

Reno Nevada 1960s Postcard Reno At Night Harold S Club Casino Ebay

Women S And Girls Apparel Sales Representative Salary In Reno Nv Comparably

Sales Tax Deduction How It Works What To Deduct Nerdwallet

Fix Sought On Sales Tax Issue For Out Of State Gun Sales The Nevada Independent

.png)